Below you’ll find many tips, videos, articles, tools and several other resources for diabetics. While we do our best to keep up with the quickly changing industry, we are not perfect.

If you find one of our resources or guides to be out of date, feel free to let us know!

Have interesting information or a resource you’d like to share with us? Let’s connect! You can click here for the requirements.

Articles, Tools, And Other Useful Resources For Diabetics

We discuss a very wide range of topics as they relate to diabetes, like diet, exercise, medications, new technology, awareness and more.

We discuss a very wide range of topics as they relate to diabetes, like diet, exercise, medications, new technology, awareness and more.

Here are some other topics which are most frequently asked about:

- Insulin Resistance

- Diabetes Alert Dogs

- Diabetic Ketoacidosis (DKA)

- Ketosis (as it may relate to the ketogenic diet)

- Hypoglycemia/Hyperglycemia

- A1C

- Diabetic Retinopathy

If you’re looking for topics specifically related to life insurance, please check out these pages:

- Life Insurance For Type 1 Diabetics

- Life Insurance For Type 2 Diabetics

- Life Insurance With Gestational Diabetes

- Life Insurance And Pre-Diabetes

- Sub-Standard Rating Systems

- Top 5 Best Life Insurance Companies For Diabetics

Remember, everyone is unique. What may work for you, may not for someone else.

Always use your best judgment, and never make any modifications to a regimen without first consulting a health professional or specialist.

If you find our information pertinent or interesting, feel free to share with your friends and family. We’re all in this together.

Important Diabetes Links

- American Diabetes Association

- National Institute of Diabetes, U.S. Dept. Of Human Health & Services

- Diabetes Research Institute Foundation

- Diabetes Daily

- American Association of Diabetes Educators

- National Diabetes Education Program

More Resources For Anyone With Diabetes or Pre-Diabetes

Managing diabetes is a lifelong task requiring a firm dedication to your health. This prospect can be overwhelming at times, especially if you have a new diagnosis and are just beginning to understand your condition, treatment, and insurance options.

But thankfully, in this modern era, we have a wealth of information at our fingertips at all time.

The internet is full of information which will help you not only manage your diabetes but manage the often particularly confusing world of insurance coverage with a chronic condition.

Let’s take a look at some of the most powerful online insurance resources for diabetes.

Get Help with Prescriptions

The American Diabetes Association (ADA) offers a huge list of Prescription Assistance Programs, including medication discount programs and databases. These tools can be used to make the necessary prescription medications and diabetes supplies more affordable.

These prescription resources are especially useful if you have no health coverage, or if your health insurance plan is less than ideal when it comes to prescription cost and coverage.

Consider gathering a list of all your needed supplies and medication, then checking the different resources on this list to see what assistance is available.

Find Support Through Forums

Forums are an excellent tool made possible by modern technology. Here you can find first-person advice, learn from other’s experiences, and find emotional support as you cope with a sometimes challenging condition.

One of our favorite forums is on TuDiabetes.org. This site has an active and helpful community. And it offers years’ worth of past discussions and resources.

The topics on TuDiabetes run the gamut, including medical treatments, information on maintaining mental health, research for a cure, and yes, finding insurance coverage and the best coverage options.

The site also has a sister Spanish language site and forum – EsTuDiabetes.org.

There are hundreds of other online resources for social support and information gathering. You can experiment with and participate in different forums and communities until you find one that is the right fit for you.

Some other popular diabetes forums and support groups include:

- MyGlu.org – a type 1 diabetes community

- DiabetesSisters – an online community for women with diabetes

- Children with Diabetes – a network for children and families dealing with diabetes

- The DiabetesDaily Forums – an active and comprehensive community

- Diabetic Connect – a social networking site aimed at empowerment and lifestyle issues

Properly Prepare for Life Insurance Applications

As you go through the processes of calculating how much insurance you need, deciding on the product, and ultimately applying, you can actually go ahead and start preparing yourself to save money.

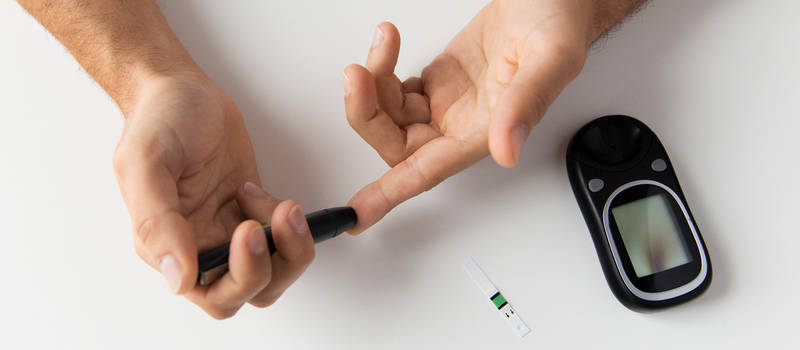

If you are in the market for a life insurance plan and have a chronic condition like diabetes, you can expect a physical exam will be a part of your application process.

Knowing how to set yourself up for a positive exam experience now can save you hundreds down the road.

To help you prepare for this, Life Happens has a detailed article aimed at helping you prepare for life insurance medical exams.

This article will help you prepare for what to expect when receiving a life insurance medical exam, and as such is a great resource.

But, perhaps even more valuable is the article’s inclusion of tips to have a successful medical exam. A successful exam might mean more favorable life insurance coverage, which, in turn, can mean major savings on your monthly premiums!

Tips include passing on your regular morning coffee or cigarette ahead of the exam and avoiding super strenuous exercise the day or morning before.

Both of these tips will help you avoid a blood pressure spike during the exam, which may help you seem less risky to life insurers.

Calculate the Costs Of Diabetes

One of the most daunting tasks when facing a newly diagnosed condition is figuring out your budget for managing it.

With changing insurance needs, new medications, new treatment plans, a changing diet and lifestyle, and increased doctor’s visits, it can be complicated to calculate how exactly your budget might change.

For this reason, the Centers for Disease Control and Prevention’s (CDC) Chronic Disease Cost Calculator is a helpful tool.

While the cost calculator provides data on entire populations by state, it can also be used to estimate individual costs. Patients can view the chart and consider not only diabetes but several other chronic conditions. This is helpful if you are affected by more than one condition.

It is useful to know what your increased costs might be so that you can better plan, prepare, and budget for the future.

This article from Everyday Health is also helpful for considering where increased costs may come from, and how to budget for them.

Figure Out Where to Start with Health Insurance

If you’re wondering where to start when it comes to seeking and obtaining health insurance and financial assistance with diabetes, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) provides a comprehensive resource.

This website will provide details and tips on costs, health insurance options, financial assistance programs, and clinical trials. It also provides a glossary of key terms that will be important to understand as you navigate the world of insurance with diabetes.

Tackle Transitions

NIDDK also provides an excellent checklist for managing the transition from pediatric to adult diabetes care.

This tool can be utilized by both older children and their parents to help make sure that this sometimes complicated, but necessary, transition goes as smoothly as possible, without interrupting care.

The checklist includes steps which should be taken as far as a year or two before the transition to adult diabetes care. It concludes with steps which should happen at the patient’s last pediatric visit.

These measures include encouraging the young patient to become more engaged with their health insurance by becoming responsible for carrying insurance cards with them and helping to make insurance claims in the year before the transition, for example.

Navigate the Marketplace

The American Diabetes Association offers a great overview and introduction to understanding the health insurance marketplace and how to navigate it with diabetes.

This resource helps describe when you can enroll, how the options relate to your diabetes, financial assistance, benefits covered, and more.

These topics are particularly important to understand if you are unable to get health insurance through your employer.

It is also important to keep informed on these topics, as federal insurance policies and national options are likely to change with different administrations and will vary from state to state.

Understand the Local Environment

Speaking of state to state variations, this report from the National Conference of State Legislatures (NCSL) provides a great overview of diabetes health coverage across different US states.

This site can be a good starting place for understanding coverage requirements and policies in your area.

It is also extremely helpful if you are considering an out of state move, or applying to colleges in different states and wondering how your diabetes insurance and care might be affected.

Stay Up-to-Date

It can be hard to keep up with the ever-changing landscape of insurance, medical treatment, and diabetes research. Diabetes Daily can help make the process easier by providing a wealth of diabetes-centric news all in one place.

Topics range from promising treatments to new programs from insurance companies, to coverage options, to lifestyle tips, like recipes. This site won’t just help you stay engaged, it can let you know of new insurance options and programs that may be available.

Make Sure to Manage Your Diabetes

This diabetes management checklist from NIDDK is a great resource.

Whether you just received a diabetes diagnosis or have been managing the condition for years, it is smart to check back in periodically and make sure you are doing everything you can to stay healthy and manage your diabetes.

This is not only good for your long-term health, but it is also helpful when it comes to obtaining insurance, particularly life insurance.

Being able to show you have been actively managing your condition can go a long way when it comes to finding the coverage you need at a cost you can afford.

Tips on the list include cooking the proper portions of fish and lean meat, keeping stress levels in check, and checking your feet for issues like swelling or cuts.

It also provides information on three key measurements you’ll want to stay on top of – your A1C blood glucose test, your blood pressure, and your cholesterol. Talk to your doctors regularly about where your levels currently are and how you can better manage them.

Reach Out

These tools all represent excellent resources available on the web to help you navigate your insurance needs as a diabetic. But don’t forget to reach out to in-person resources.

Your doctors and other medical professionals are great sources of information and may have insight into local diabetes communities and resources.

In-person support groups can be a great source of emotional support and a way to build a community in your backyard. And your local state or city government might offer programs and assistance to diabetics.

Whether online or in person, don’t weather the storm alone. Utilize the wealth of resources and tools available to you to help to navigate your diabetes insurance needs easier, simpler, and less stressful.